If you are a publisher and have never tried Google’s feature named Open Bidding, you might be missing out on many significant benefits, especially increased ad revenue. But don’t worry, this blog will provide all the basic information about Open Bidding, along with frequently asked questions.

Google introduced the Open Bidding feature, previously known as EBDA, to publishers in 2018. It’s a server-side alternative to header bidding. Google proudly describes their product as better than header bidding due to its ease of setup and minimized latency. However, to evaluate Google’s claims, you need to understand Open Bidding in detail objectively, which this article aims to help you with.

What is Google Open Bidding?

Google Open Bidding is a feature in Google Ad Manager (GAM) that optimizes programmatic advertising for publishers. It enables numerous demand partners, including ad exchanges and demand-side platforms (DSPs), to bid on ad inventory in a single, real-time auction. This mechanism ensures that publishers receive the highest bids for their ad impressions, enhancing competitiveness and potential revenue.

More to discover

Key Programmatic Advertising Trends in 2024

Open Bidding enables publishers to invite a number of yield partners to bid for their ad inventory in a single auction. These yield partners, which include ad exchanges and demand-side platforms (DSPs), make real-time bids to secure ad impressions. Because the best potential offer is selected for each impression in this competitive market, ad fill rates and eCPM (effective cost per thousand impressions) will tend to increase.

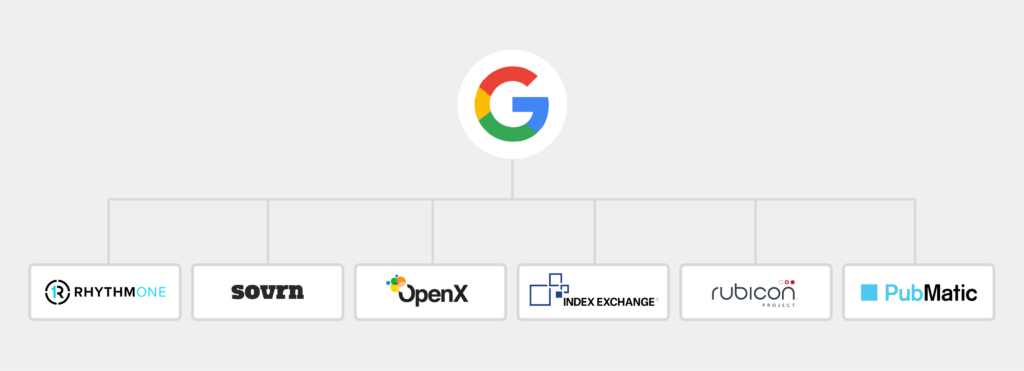

Unlike Open Bidding, which uses multiple demand sources to reduce empty ad spaces, relying solely on Google Ad Exchange results in lower fill rates and eCPM due to fewer bidders and bids. Open Bidding integration of numerous partners guarantees that publishers are able to maximize their ad revenue potential by getting higher bids from a diverse range of advertisers.

How to Determine Which One is your Best Yield?

Before determining which yield best suits their needs, it is noted that this process is not conducted automatically. Publishers must establish a written contract with yield partners before allowing them to bid on their inventory. Google only provides the auction platform which is Google Ad Manager, and does not directly handle the agreements and contracts between publishers and yield partners.

Google Ad Manager guarantees that publishers can get the maximum potential yield by running unified auctions. To further maximize revenue, dynamic allocation is employed to include additional direct line items.

Here is a four-step process to select the best line items and maximize publisher revenue.

Select Highest-Paying Line Items

GAM identifies the highest-paying line items to compete in the unified auctions.

Choose Relevant Line Items

The most relevant line items are then chosen to participate.

Bid Request to Yield Partners

GAM sends bid requests to targeted yield partners and the highest bidder wins the ad space.

Select Winning Bid

The winning bid is selected, and the server sends it to the publisher after completing the dynamic allocation and unified auction process.

By following this structure, Google Ad Manager helps publishers achieve optimal revenue from their ad inventory.

How Open Bidding Works in Google Ad Manager?

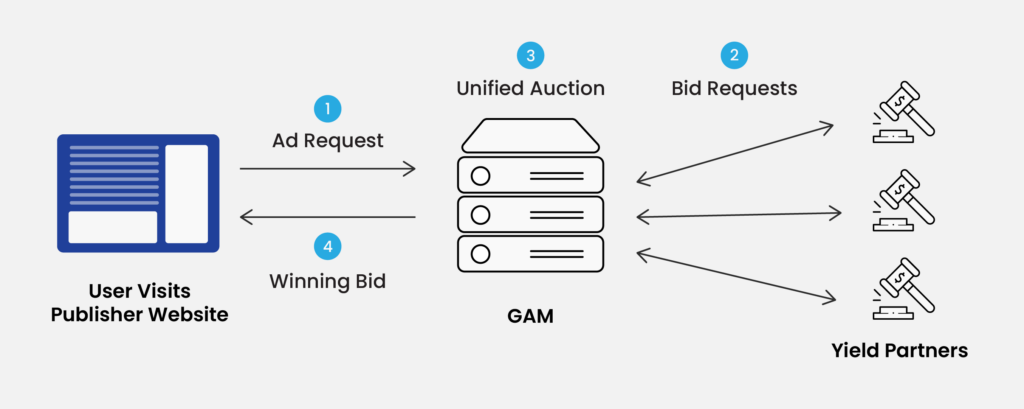

Open Bidding in Google Ad Manager is a server-side auction procedure that enables multiple demand partners to bid on a publisher’s ad inventory at the same time. Here’s a detailed description of how it works in an easy to understand way:

Step 1: Ad Request: When a user visits the publisher’s webpage, an ad request is sent to Google Ad Manager. Information about the ad units, such as format, size, and user demographics (if allowed), is also included.

Step 2: Bid Requests: GAM sends bid requests to multiple yield partners. These yield partners are various ad exchanges and demand-side platforms that will compete for the ad impression.

For example, if the available impression is on a 300×250 ad unit, only the buyers interested in targeting this specific size have the opportunity to receive the bid request.

Step 3: Unified Auction: When the demand-side has submitted the responses, GAM conducts a unified auction that includes yield partners, Ad Exchange, and other direct line items.

Step 4: Winning Bid: In the unified auction, the highest bid wins. Finally, the winning ad is delivered by GAM to the publisher’s webpage, and the ad is displayed to the user

This process illustrates how the Open Bidding feature operates in Google Ad Manager to ensure revenue maximization, with the highest bidder winning the auction. The server-side nature of this process helps reduce latency and improves efficiency compared to other traditional client-side bidding methods.

Weighing the Advantages and Disadvantages of Google Open Bidding

After gaining an overview and a basic understanding of Google Open Bidding, it is also crucial for publishers to look deeper into its pros and cons before deciding to implement it. Understanding both the benefits and potential drawbacks allows publishers to make informed decisions.

Advantages of Google Open Bidding

- Increased Competition: The Open Bidding feature can enhance competition for ad inventory on web pages by allowing multiple partners to bid in real-time. This also helps increase overall ad revenue and raise eCPM for publishers.

- Reduced Latency: User experience is enhanced with faster ad load times thanks to Open Bidding operating server-side. Additionally, page load speeds are also quicker even before the auction occurs, as it does not rely on JavaScript during runtime.

- Simplified Management: Since Open Bidding is a feature directly integrated into Google Ad Manager, setting up and managing ad auctions becomes simpler than with any other method.

- Improved Analytics and Reporting: Publishers can easily optimize their ad strategies on account of detailed reports and accurate performance insights of Open Bidding provided by Google Ad Manager.

- Unified Auction: All demand sources, including Google Ad Exchange and third-party exchanges, participate in a single unified auction to ensure that the highest bidder wins and maximizes yield per impression.

Disadvantages of Google Open Bidding

- Dependency on Google: Since Open Bidding is a Google feature, relying on their ecosystem can create a dependency. This inherently limits flexibility and control over ad operations. Google also manages all features like reporting and payment processing, so publishers have less control over the auction process.

- Revenue Sharing: Publisher’s net revenue may be reduced compared to direct deals or other auction types because they are conducting Open Bidding transactions on the platform that Google provides. This means that Google takes a percentage of the ad revenue as a fee for using their Open Bidding feature.

- Potential Conflicts: Managing profits can become complicated if you integrate too many demand partners. This is because conflicts or discrepancies in bidding and auction outcomes may occur.

- Complex Setup: To use the Open Bidding feature, in addition to having an ad exchange account connected to GAM, publishers must also agree to sign an Open Bidding addendum on the contract.

- Bid Data Visibility Restricted: Although Google offers advanced analytics and reporting for publishers to refer to, they do not have access about the individual bids placed by demand partners in each auction.

How to Setup Open Bidding in Google Ad Manager?

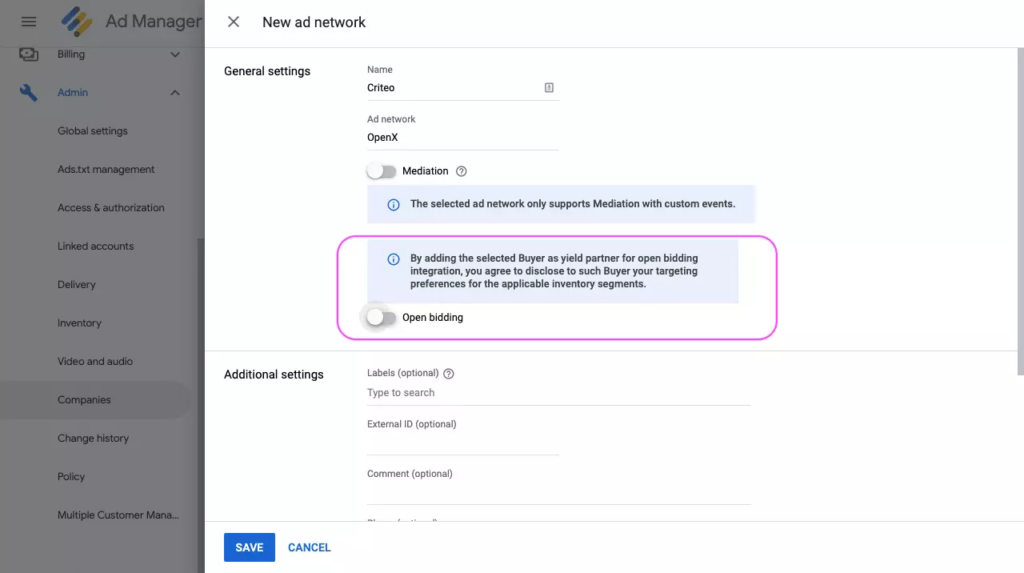

Step 1: Enable Demand Partners for Open Bidding

1. Access Demand Partner Settings

– Go to Admin -> Companies.

– Select the appropriate type of partner, such as Advertiser, Ad Network, Agency, or House Agency.

2. Enable Open Bidding

– If you’re working with an ad network, select Ad Network.

– Enter a name for the network.

– Check the box for “Enable for Open Bidding”.

– A pop-up will appear; click Acknowledge to enable the network to bid on your inventory through exchange bidding.

– Save your settings.

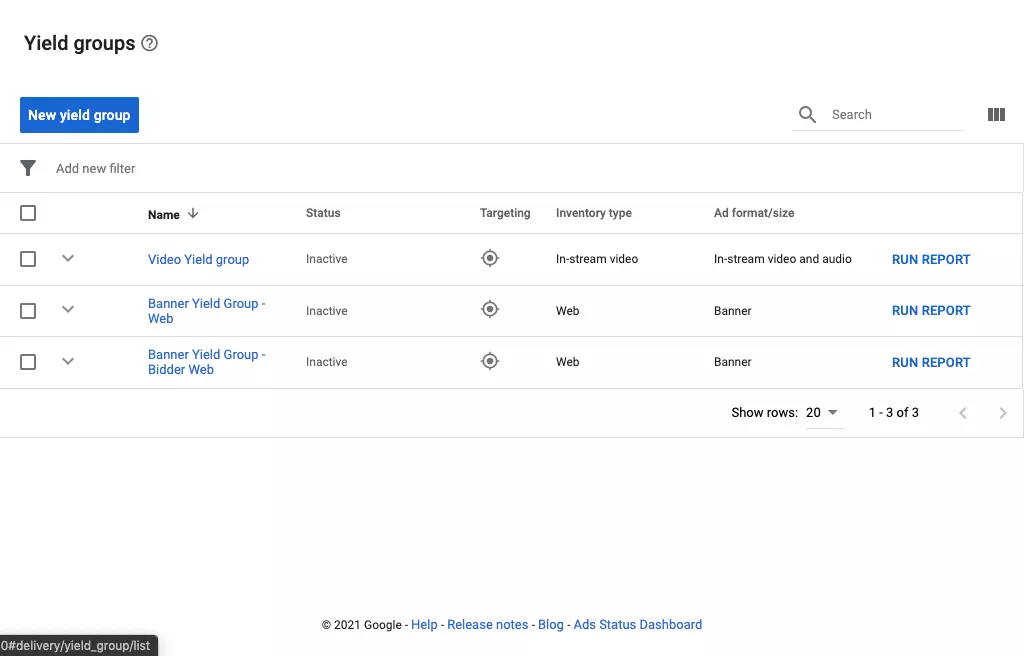

Step 2: Create Yield Groups

A yield group specifies which ad inventories are available for Exchange Bidding and to which partners.

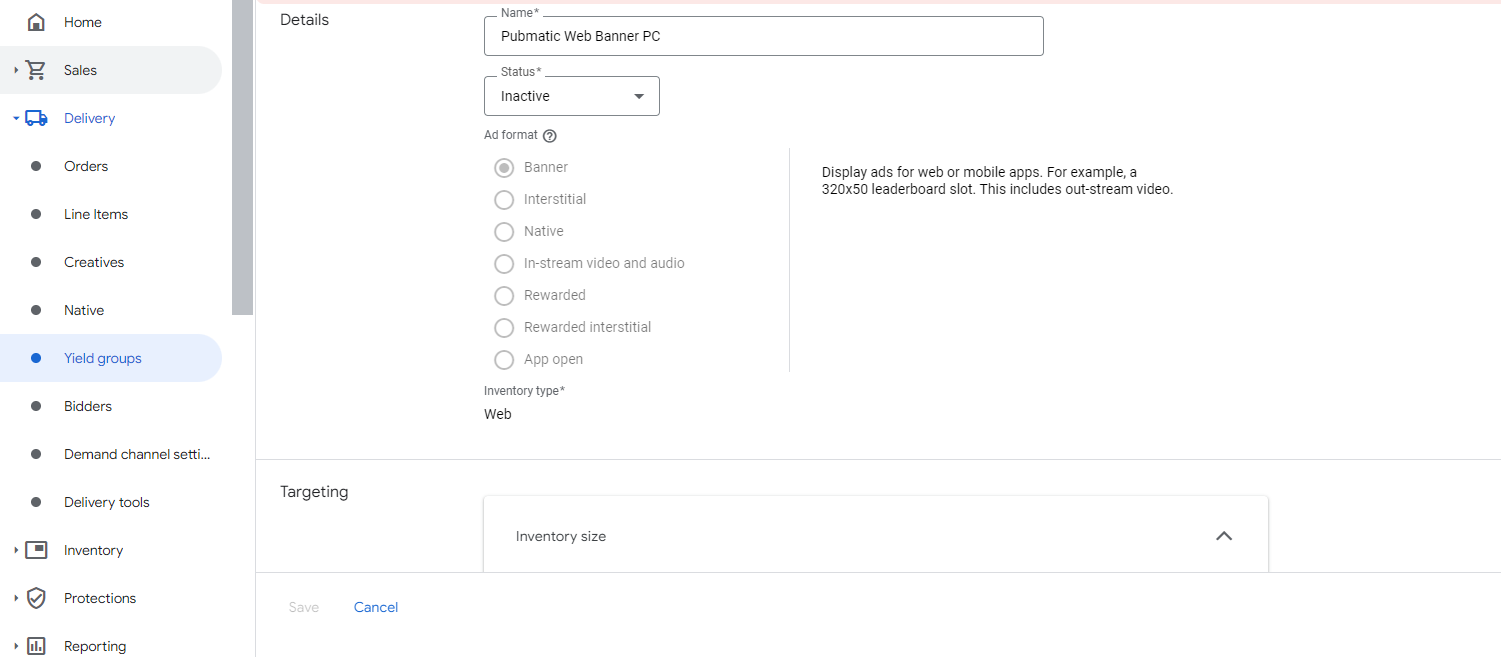

1. Set Up a New Yield Group

– Go to Delivery -> Yield groups -> New yield group.

– Name your yield group, for example “Pubmatic Web Banner PC”.

– Select the ad formats supported by this group: Banner, Interstitial, Native, In-stream video and audio, or Rewarded.

– Choose the inventory type (Web or Mobile app) and define ad sizes such as 300×250, 728×90, 300×600. You can include all of the available sizes.

2. Define Targeting Options

– Fill in the targeting options for your yield group.

– Save and activate your yield group.

Step 3: Add Third-Party Yield Partners

To allow third-party partners to compete for your ad inventory, follow these steps:

1. Add a Yield Partner

– Go to Add yield partner -> Select a yield partner.

– Choose the yield partner from the drop-down menu and click Create a new yield partner.

– Select the integration type as Open Bidding.

2. Configure Yield Partner Settings

– If targeting mobile apps, select the operating system (iOS or Android).

– Enter the default CPM value manually or select Dynamic CPM to set it automatically. For dynamic CPM, enable automatic data collection when adding the ad network.

– Don’t forget to save all of your settings.

Note: You can add up to ten third-party yield partners to a single group.

Check the Performance of Open Bidding

Google Ad Manager provides publishers with various metrics through detailed reports on the performance of the Open Bidding feature. The following detailed steps will provide specific insights to optimise the ad campaigns accordingly.

Step 1: Access the Reporting Feature

– Go to Reports in Google Ad Manager.

– Click on New report -> Historical to create a new report with historical data.

Step 2: Configure the Report

– Enter all the required details for your report.

– Set Dimensions to Yield Group.

– Choose your Metrics that fits with your desire. Options include

- Yield Group Bids

- Yield Group Auctions Won

- Yield Group Estimated Revenue

- Yield Group Estimated CPM

- Yield Group Successful Responses

Step 3: Generate the Report

– Select the yield groups you want to include in the report.

– If you want to analyze any individual partner, go with the next step:

Step 4: Analyze Individual Partner Performance

– Go to Reports -> Queries -> Historical

– Choose Yield Groups to select the specific yield group you want to analyze.

– Select the partner to review its performance.

What are the Differences between Open Bidding and Header Bidding?

If publishers are wondering which method, Open Bidding or Header Bidding, is most suitable for their webpage and demand, they should refer to the following board. It quickly compares and contrasts the main features to help them make the most accurate decision.

| Features | Open Bidding | Header Bidding |

|---|---|---|

| Auction host | Server-side | Client-side (browser) |

| Latency | Lower latency thanks to server-side operation | Higher latency as it runs in the user’s browser |

| Setup Complexity | Simplified setup in Google Ad Manager | More complex setup |

| Management | Managed within Google’s ecosystem | Managed through multiple partners and platforms |

| Revenue Share | Google takes a revenue share | No mandated revenue sharing with header bidding partners |

| Control | Rely on Google’s ecosystem | Managed by the publisher |

| Bid Transparency | Individual bid details not provided due to limited transparency | All bids can be reviewed thanks to greater transparency |

| Auction Type | Unified auction with Google Ad Exchange and partners | Individual auctions with various demand sources |

| Support | Google provides full support | Varies depending on third-party technology suppliers |

| Payment | Managed by Google | Per each SSP or ad exchange |

More to discover

Header Bidding: A guide

Final Thoughts

Overall, Google’s Open Bidding is a useful feature for publishers to maximize ad revenue on their web pages. However, it is unwise to apply this feature without thoroughly considering your specific case, as it is crucial to evaluate its potential limitations. By in depth understanding the pros and cons, publishers can make an informed decision that aligns with their ad strategy and helps them achieve optimal results.

Frequently Asked Questions

1. Can Open Bidding be used alongside Header Bidding?

Yes, many publishers use both methods to maximise their ad revenue but managing both simultaneously can be more complex that just using one.

2. How to optimize Open Bidding setup for the best results?

To optimise Open Bidding for the best results, publishers should regularly view performance reports on Google Ad Manager, adjust yield groups and calibrate targeting options to match the audience.

3. Does Open Bidding work faster than Header Bidding?

Yes, it is. Generally, Open Bidding runs faster than Header Bidding. Open Bidding operates server-side, which allows it to reduce latency. In contrast, Header Bidding runs on client-side, which may slow down page load times.

0 Comments